LBTT threshold increased to £250,000 and £50m added to First Home Fund

The threshold at which Land and Buildings Transaction Tax (LBTT) is paid will be raised from £145,000 to £250,000 as the Scottish Government steps up efforts to support homebuyers and help the economy recover from the impact of coronavirus.

Announcing the move to parliament yesterday, finance secretary Kate Forbes said the change means 80% of house buyers will be exempt from the charge – excluding the Additional Dwelling Supplement. Home movers purchasing a property costing more than £250,000 will save £2,100.

The decision came in response to Chancellor Rishi Sunak’s Summer Statement in which he announced plans for a stamp duty cut in England and Northern Ireland until the end of March 2021, prompting calls for Scotland to follow suit.

In addition, an extra £50 million is being added to the First Home Fund, a shared equity scheme providing first time buyers with up to £25,000 to buy a property. The finance secretary said this will support an estimated 2,000 first time purchases and increase the total funding to £200m.

A further £100m is being invested in targeted employment support and training, with further details on this expected from economy secretary Fiona Hyslop in due course.

Ms Forbes said: “I have listened to calls to raise the starting threshold for LBTT to help stimulate housing market activity and the economy. Today’s changes will benefit house buyers and are focused directly on the particular needs of the Scottish economy.

“To ensure first time buyers can also benefit, I will provide an additional £50m this financial year to directly support them to get on the property ladder.

“On employment, the Chancellor’s announcement included UK-wide schemes that will apply in Scotland, but I believe more is required to support the labour market.

“We will therefore make an additional £100m available this year for targeted employment support and training. I recognise that we still need to do more to support employment and skills, but this is a step in the right direction.”

The change to LBTT will come into force as soon as possible, allowing time for legislation to be prepared and for Revenue Scotland to be ready to collect and manage the tax. The rates for the Additional Dwelling Supplement and non-residential LBTT remain unchanged.

The initiatives will be part funded by money expected to be received by the Scottish Government following the UK Government’s stamp duty decision and from the Scottish Government’s financial transactions budget.

Homes for Scotland responded to the announcement with a call for clarity on the timing of the LBTT change.

Director of policy Fionna Kell said: “These announcements are welcome support for the Scottish housing market but both require further action if the benefits are to be fully maximised for individual customers and the wider economy.

“On LBTT, it is absolutely crucial that we get an early date for implementation otherwise we are at risk of seeing already fragile market recovery stall as buyers delay purchases.

“With regards to the First Home Fund, this will help those who have been affected by mortgage lenders reducing Loan to Values but we also need to see the scheme extended beyond next March as so many transactions and housing completions have been delayed by the construction shutdown.

“Both of these issues are core elements of the industry recovery plan we are preparing to submit to the Scottish Government.”

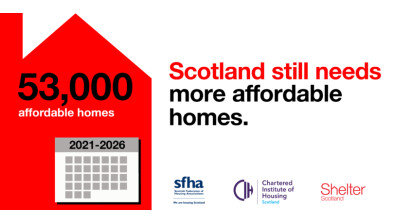

Shelter Scotland said the Scottish Government’s focus should instead be on “urgent” social housebuilding.

Director Alison Watson said: “Cuts to LBTT are no substitute for the construction of affordable homes.

“The Scottish Government should prioritise the resources it has to urgently invest in social housebuilding. This will stimulate the economy, protect and create jobs, and provide homes to those in greatest need.

“As we face the most serious economic downturn in living memory, we need decisive action that matches the scale of the crisis.

“While additional funding for discretionary housing payments to help renters is welcome, these are only available to people on social security benefits and it’s unlikely to be enough to stop a tidal wave of evictions and new cases of homelessness.”

Property firm apropos, which had warned of a collapse in Scotland’s property market if the cut to stamp duty wasn’t matched north of the border, said the LBTT threshold increase is a start but more needs to be done to ensure Scotland’s homebuyers are treated as equally as their English counterparts.

David Alexander, joint managing director of apropos, said: “It is welcome news that Scotland’s Finance Minister Kate Forbes has increased the threshold when LBTT is to be paid but the property market does not exist in isolation. Such a substantial tax difference north and south of the Border will have a negative impact on individual homebuyers, and property investors.

“At a time when we must do all we can to encourage economic growth in Scotland it seems extraordinary that the Scottish Government should not be offering comparable property tax cuts to England and Northern Ireland.”

Mr Alexander added: “Of further concern is that this change is not being immediately implemented. The result of this delay will be complete stagnation in the housing market until buyers know the date that the new threshold will begin.

“It is essential during these uncertain times that there is a degree of assuredness and decisiveness to provide confidence in the housing market. Property activity is often about sentiment and mood and for buyers and sellers to be left without any sure sense of when change is going to come and why it does not match the rest of the UK seems to me to be extremely problematic.

“The economy is volatile at the moment and we can expect the property market to be impacted if the right decisions are not made at the right time. I would urge the Scottish government to match the Chancellor’s £500,000 threshold and to implement it immediately to avoid a negative and, potentially, disastrous impact on the property market in Scotland.”

The Chartered Institute of Taxation (CIOT) agreed that a quick start to the threshold increase is crucial.

Joanne Walker, CIOT Scottish technical officer, said: “There is a risk that by not increasing the threshold immediately, people will put off buying a house until the tax change takes effect so that they can benefit from today’s announcement. It will be important for the Scottish Government to set out quickly when these changes will take effect to prevent the housing market stalling in its recovery.

“Once implemented, the changes will mean that an additional 34% of transactions will be taken out of LBTT, taking the total to 79%. This will generate a maximum saving to taxpayers of £2,100.

“That said, it remains the case that across the UK, there is still some uncertainty over who gains from a change of this kind. A 2011 UK government study found that previous cuts to help first-time buyers were mostly absorbed in a higher house price, benefiting sellers rather than purchasers.”

Dr Liz Cameron, chief executive of the Scottish Chambers of Commerce, said: “This will not only boost the housing market it will also support the construction industry, both of which are essential to addressing Scotland’s chronic housing shortage.

“We ask that this should be urgently fast tracked to prevent distortion in the marketplace.”

Sean McGinness, head of the real estate practice group at Saffery Champness, added: “The measure will be welcomed by housebuilders and developers, who will hopefully be buoyed by the fact that the average new build home in Scotland, costing around £225k, will now face no LBTT which should stimulate demand and activity in the market. However, just as in England the question will be whether housebuilders can achieve the right level of completions to meet demand without over-producing and being left with unsold stock when LBTT increases back to its normal level - which could reduce margins.

“In addition, the disparity between the tax thresholds in Scotland and England means activity at the upper end of the market in Scotland is likely to be dampened. Particularly in major urban centres like Edinburgh properties are routinely valued at over £500k which, in England, would now be free of SDLT but which in Scotland would only see a minor reduction and an expected tax bill of over £20k.

“Perhaps most importantly, though, the silence thus far on when the measures will actually take effect could have a paralysing effect. However attractive on paper, buyers are highly unlikely to follow through on any transactions until there is clarity, which could have a detrimental near term impact on those housebuilders struggling with cash flow issues. It is hoped the Government act soon to bring into force the increased nil rate band.”

Faisal Choudhry, head of Savills Residential Research in Scotland, said: “This is good news for buyers of Scottish property who will save money in what is likely to be a challenging economy. It is also positive for sellers who will see demand for property rise further. Clearly the move will largely benefit first time buyers, however there will be a knock-on effect throughout the market which will have a stimulating effect on the economy.

“This is the first time the LBTT structure has been tweaked since it was introduced five years ago, and we hope that this will be part of a long term adjustment rather than a short-term fix. If you are buying at £250,000 and above under the new regime you will now be saving £2,100. Although the saving is larger in England, Scottish property still represents comparatively good value for money. Prior to the pandemic, Scotland had seen record market activity, with demand outstripping supply.

“The Scottish finance minister has not been able to confirm when the regime will start, but clearly there is some urgency required here as the announcement could have a negative effect in the short term while people sit on their hands until the new rates are introduced. This would be counterproductive in terms of the Scottish Government’s aims of raising tax revenue, stimulating the economy and supporting the market in Scotland.”

Kevin Maley, head of residential agency for Strutt & Parker in Scotland, said: “The rise in the threshold from £145,000 to £250,000 is a boost for the property sector. The temporary relief will undoubtedly stimulate the property market, which will in turn help strengthen the economy as we navigate our way out of lockdown. It will encourage more people to put their homes on the market, even beyond the normal seasonal window.

“As a result of the pandemic, the government will have seen a decline in LBTT yields, which is bad news for the country’s finances, so this might be the kick start for the economy that everyone is hoping for.

“As a result of the speculation on changes to LBTT in the last week, we have already had conversations with clients, some of whom indicated that they would be likely to consider putting their houses on the market as a direct result of any cut.”

Mr Maley called for clarity on the timing for the change, adding: “We welcome the tax cut and hope we receive further guidance on its implementation shortly to avoid any unnecessary uncertainty.”