Scottish PRS rent rises ‘among the highest in Britain’

New tenants renting from private landlords in Scotland have been faced with the highest percentage rental increases in Britain outside London, according to a new survey.

New tenants renting from private landlords in Scotland have been faced with the highest percentage rental increases in Britain outside London, according to a new survey.

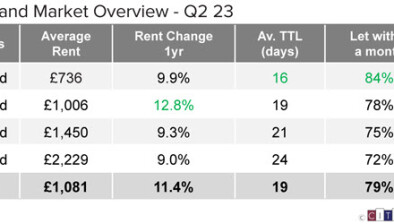

The latest figures from the HomeLet Rental Index reveal that rents on new tenancies signed on a UK rental property outside of London over the three months to March 2016 were, on average, 4.9 per cent higher than in the same period of last year.

The figure in Greater London was 7.7 per cent higher than a year ago, although Scotland wasn’t far behind with an increase of 7.3 per cent in the same period, just ahead of the East Midlands with 6.8 per cent.

HomeLet’s research shows that rents continue to rise significantly ahead of inflation, with demand for property remaining strong.

London’s rental market, where the average rent on a new tenancy is now £1,536, continues to see rents rise more quickly than in other areas of the country. At 2.8 percentage points, the gap between rent rises on new tenancies in London and the rest of the UK, where rents average £755, was almost identical to last month (2.9 percentage points). Just one area of the UK, the North West of England, saw lower rents on new tenancies over the three months to March, with the HomeLet Rental Index recording a fall of 3.5 per cent over the year.

Martin Totty, Barbon Insurance Group’s chief executive officer, said: “We’ve continued to see increases in rents on new tenancies in almost every part of the UK during the first quarter, as the private rental market has responded to the pressures of an imbalance between demand and supply.

“However, external factors may now come into play: the stamp duty increase has already had an impact and that surge in the acquisition of property by landlords could now cause a short-term increase in the supply of rental property in some areas of the country. In the longer term, changes to rules around buy-to-let mortgage interest being offset against tax bills, coupled with the Bank of England’s instruction to lenders to apply more exacting criteria on buy-to-let lending, may have a limiting effect on supply. The data from the HomeLet Rental Index will be eagerly anticipated over the next few months as an indicator of the impact these changes have may have on the market.

“However, despite these factors, we expect the private rental sector to continue to play a crucial role in a housing market where population growth will continue for the foreseeable future according to official projections.”