£80m debt facility secured to fund construction of Glasgow build-to-rent scheme

The joint venture behind the delivery of a build-to-rent neighbourhood on the site of the former Strathclyde Police headquarters in central Glasgow has secured £80 million of debt funding to finance its construction.

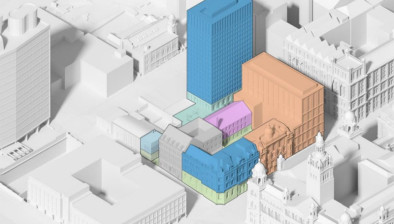

Named Holland Park, the 433-home development is the fifth investment to be brought forward in the Apache Capital and Harrison Street joint venture and will be developed and operated for the long term by Moda Living.

The four-year debt facility provided by BentallGreenOak will fund the construction and stabilisation of Holland Park. Start on-site for the first phase is due shortly, with completion expected in late 2023. Demolition work was completed in March 2020.

Prior to providing construction financing for Holland Park, BentallGreenOak had helped fund a number of site acquisitions by Apache Capital in core cities across England and Scotland. The company has also previously provided construction financing for Harrison Street and Torsion Developments’ 290-studio student accommodation scheme in Birmingham.

As well as creating new homes, Holland Park will provide 15,000 sq. ft. of internal amenities, including communal lounges and health and well-being zones. A further 31,000 sq. ft. of outdoor amenity space will be provided, with the four apartment buildings that form Holland Park to be set around a courtyard open to the wider public during the day.

Residents will also have access to landscaped terraces overlooking the Glasgow skyline, while mixed commercial and leisure space will be provided on the ground floor, including cafes, bars, restaurants and co-working facilities.

John Dunkerley, co-founder and CEO at Apache Capital Partners, said: “The backing of one of the world’s leading real estate investment managers for our Holland Park scheme with Moda Living highlights lenders’ growing comfort with build-to-rent as an asset class.

“Covid-19 has revealed the vulnerability of traditional property investments such as retail and offices to disruption. As a result, lenders, together with institutional investors such as pension funds and insurers, are looking to grow their exposure to alternative asset classes like residential for rent.

“The leasing success at Angel Gardens, our flagship build-to-rent scheme with Moda Living, has demonstrated the resiliency of our highly amenitised, highly serviced model and we anticipate strong consumer interest in Holland Park once it completes.”

Paul Bashir, chief executive officer of Harrison Street’s European business, said: “Glasgow is an attractive Scottish city with large banking, insurance, energy and telecommunications employers, and its growing population needs high-quality rental housing options. We are pleased with the support from leading international real estate investment manager, BentallGreenOak to build upon our existing partnership.

“Harrison Street looks forward to completing Holland Park with world-class partners, Apache and Moda and continuing to identify new opportunities for top-tier BTR assets with high-quality amenities in strategic markets.”

Jim Blakemore, global head of debt at BentallGreenOak, said: “Against the backdrop of pandemic-related uncertainty we are seeing across the real estate market, build-to-rent continues to perform well, and we are delighted to be supporting a best-in-class product that Apache Capital, Harrison Street, and Moda Living have created.

“We see a huge amount of opportunity across living real estate and hotels, and believe that demand for agile and relationship-driven debt partners will only grow.

“As traditional lenders continue to pull back from the market, there will be a huge growth opportunity for alternative providers. With a well-capitalised, global footprint we are able to act quickly and help our clients secure the deals they want and build those relationships over the long term.”

Johnny Caddick, CEO at Moda Living, said: “The backing of a major global real estate player such as BentallGreenOak is another testament to the strength and quality of the Moda product as well as a statement of confidence in our ability to deliver.

“We look forward to starting on-site at Holland Park, transforming a well-known site in Glasgow city centre into a Next Generation Neighbourhood comprising high quality homes for rent alongside market-leading amenities.”

Apache Capital and Moda Living purchased the Holland Park site in October 2016. The transaction was one of the largest property deals to take place in Scotland after the Brexit result.