Bank of Scotland: A third of Scots do not save any money

A third (34%) of adults in Scotland say they do not save any money, according to new research conducted by the Bank of Scotland.

Part of Bank of Scotland’s ‘How Scotland Lives’ study, the analysis conducted in partnership with YouGov, also found that 9% of Scottish adults have no personal savings to fall back on if they lost their job.

A further one in five (19%) wouldn’t survive more than a month if they were to suddenly lose their job and 29% would only be able to live off their current savings for up to six months. Yet, whilst knowing they may be caught short of cash, 16% do not plan their personal finances at all.

The 18-24 age group were revealed to be the most dedicated savers. Over four in five (81%) are currently saving - with a deposit for a new home or saving for a rainy day - being the main reasons for doing so.

However, one in five (21%) confess to struggling when it comes to managing their money, and 18% do not plan their finances at all.

Just under half (47%) of over 55s are confident in their ability to manage their money.

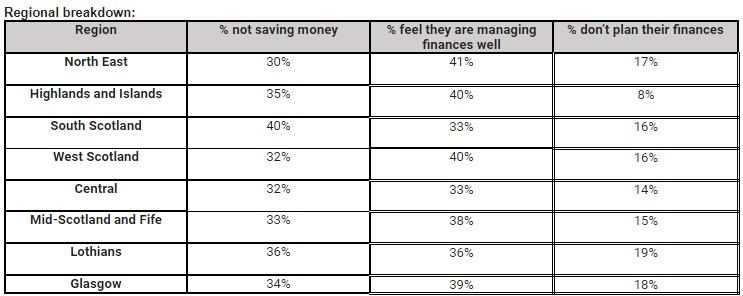

Bank of Scotland 'How Scotland Lives' regional breakdown

Ricky Diggins, director at Bank of Scotland, said: “Saving for the future can feel like a major challenge, especially with other financial pressures such as rent and bills taking priority.

“The truth of the matter is even small savings can really add up, and when done regularly over a long period of time it can result in a significant sum. There are tools and accounts available to make saving easier and simple saving tricks will help set yourself up for the future.

The report reveals:

- More people are actively saving in North East Scotland (70%) West Scotland (68%) and Central Scotland (68%) than any other Scottish region.

- People in the north east of Scotland are also likely to report that they are managing their finances well (41%), in contrast to just 29% of Glaswegians.

- Two in five are failing to save any money in South Scotland (40%) and the Lothians (36%).

- Those in the Lothians are also most at risk if they lost their employment, with just 24% reporting they could only survive for a month on their current savings.

- Saving for a rainy day topped the list for why Scots save (81%). Other reasons include helping family (60%), in case they lose their job (50%), and saving for a house deposit (47%).