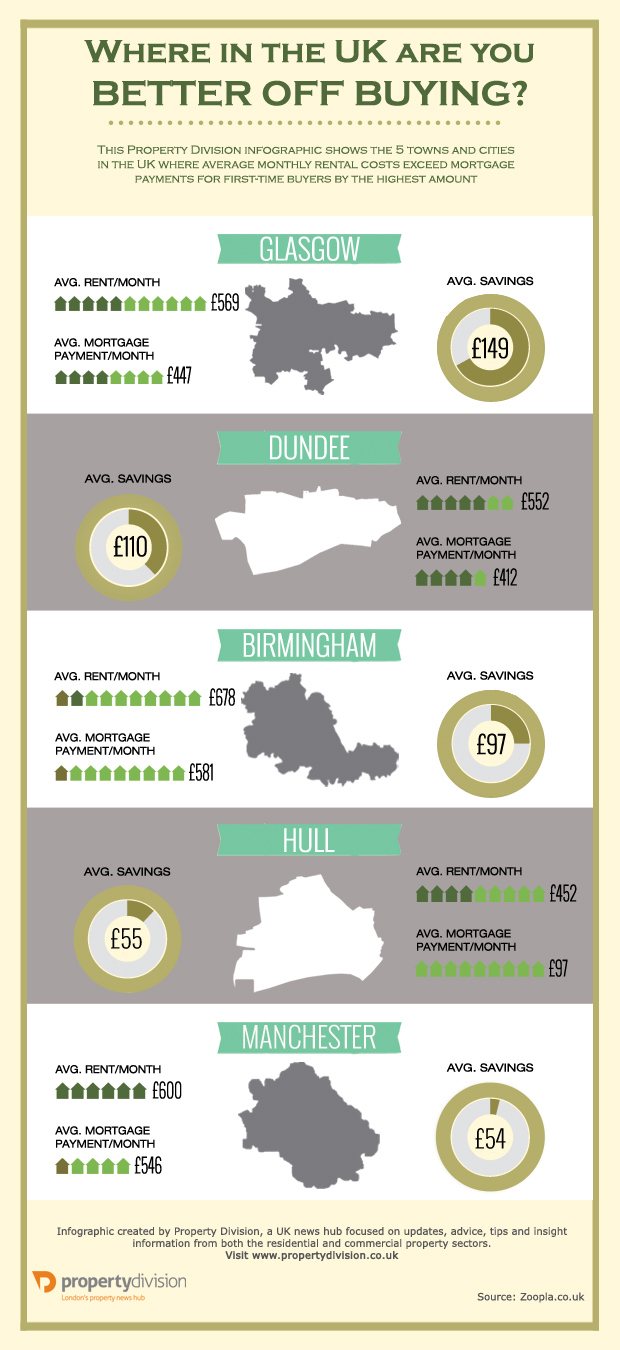

Buying vs renting: Infographics detail gap between mortgage and rental costs

New research has revealed the UK cities where houses cost less to buy than to rent and where first time buyers are better to continue renting.

New research has revealed the UK cities where houses cost less to buy than to rent and where first time buyers are better to continue renting.

An infographic produced by online property investment news hub Property Division shows that first time buyers in Glasgow could save £149 every month when compared with tenants in Scotland’s largest city, while those in Dundee would be £110 better off each month.

The analysis is based on asking prices and average rents of two-bedroom properties in each of the five locations listed below. The calculations by property portal Zoopla assume purchasers are repaying a 90 per cent mortgage over 25 years at 4.5 per cent.

Property Division CEO Nelly Berova said: “It is significant that with the exception of Birmingham every location this research identifies is in the north of England or Scotland.

“The value of residential property in these areas is way below values achieved in London and south-east England and represents an investment that is likely to deliver good returns in the long-term.”

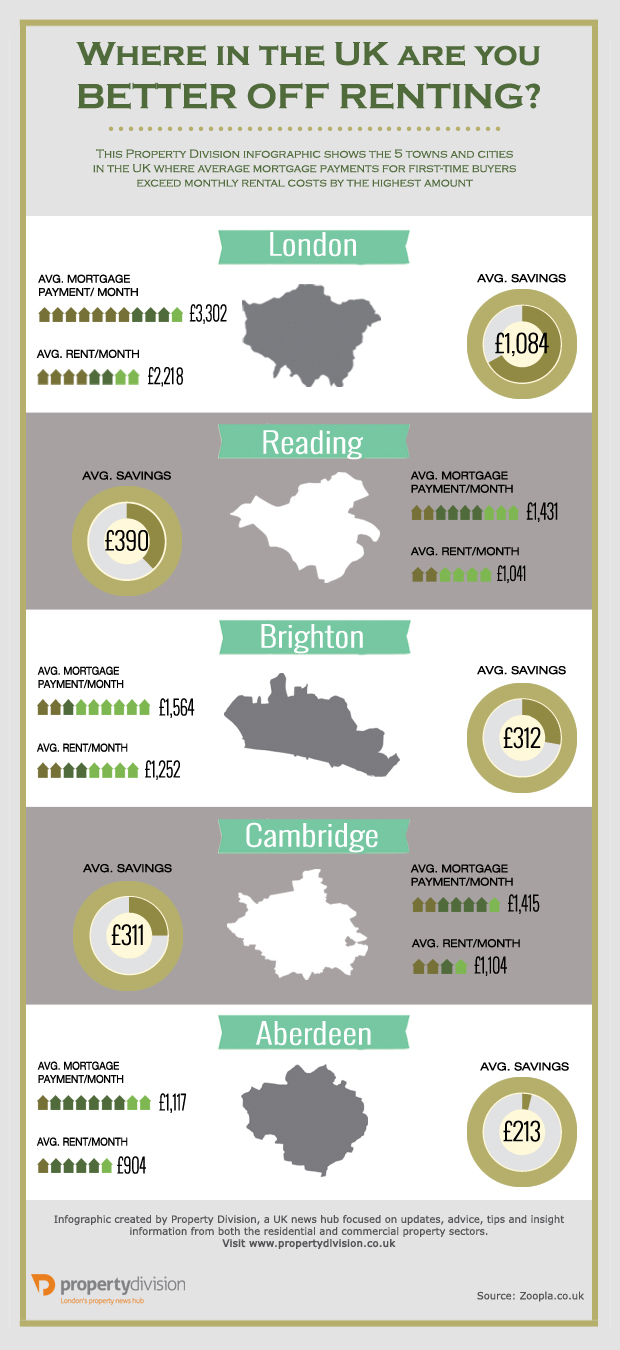

Meanwhile, a second infographic has revealed that first time buyers in Aberdeen could save themselves £213 every month if they continue renting a similar property.

According to the research, the average monthly rent of £904 is actually lower than the average monthly mortgage payments of £1,117.

Nelly Berova added: “It is significant that with the exception of Aberdeen – which has been hit by a slump in the price of oil since the data was released – every location this research identifies is in the south-east quarter of England.

“The value of residential property in these areas has increased dramatically in recent years and it is unlikely the gap between mortgage payments and rents will close any time soon.”