John Perry: The housing emergency - Scotland is already in the grip of plummeting affordable housing investment

UK Housing Review author and editor John Perry delves into one of the Scottish-focused chapters from this year’s publication.

The UK Housing Review 2024 confirms the conclusion reached at CIH Scotland’s recent conference – Scotland’s Housing Festival - that the country faces a housing emergency.

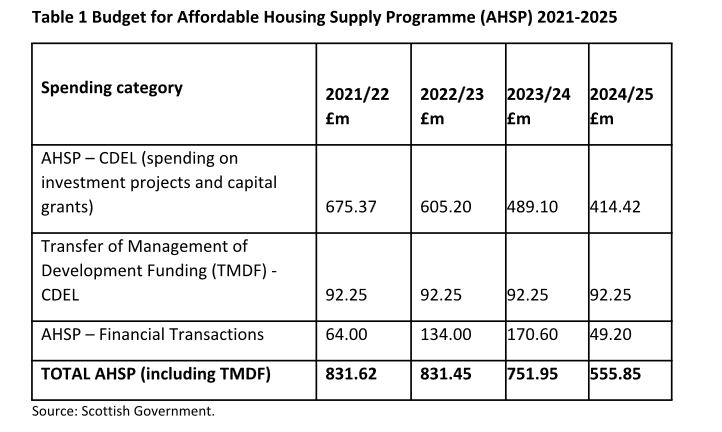

The Scottish Government’s declared commitment is to deliver 110,000 affordable homes over the decade to 2032, with at least 70 per cent being for social rent. Investment of £3.5 billion was promised over the life of the current parliament. Despite this, funding for the Affordable Housing Supply Programme (AHSP) in 2023/24 was lower than for the previous two years, and December’s Budget made a further cut of almost £200 million, to £556 million for 2024/25. This was 22 per cent less than the amount provisionally allocated for the coming year (see Table 1).

Note: Totals may be affected slightly by rounding. CDEL = Capital Departmental Expenditure Limit; TMDF = Transfer of Management of Development Funding (i.e. AHSP funding administered directly by Glasgow and Edinburgh councils).

Amidst something of a fiscal crisis in Scotland, the Scottish Government explained its ‘difficult choice’ in cutting the AHSP by pointing out that a real-terms fall of 9.8 per cent in UK government capital funding for Scotland is taking place. As well as the effect on the main grant-funding line in the AHSP, spending classified as ‘financial transactions’ has also more than halved since 2023/24. The Scottish Government previously intended to publish allocations under the AHSP for the following two financial years, but these are now postponed.

Predictably, responses to the Budget were critical, with CIH Scotland calling it ‘devastating’ and the Scottish Federation of Housing Associations (SFHA) saying it was an ‘absolute hammer blow’. Several commentators pointed out that the 110,000 target had already been at risk, but now it will be almost impossible to achieve.

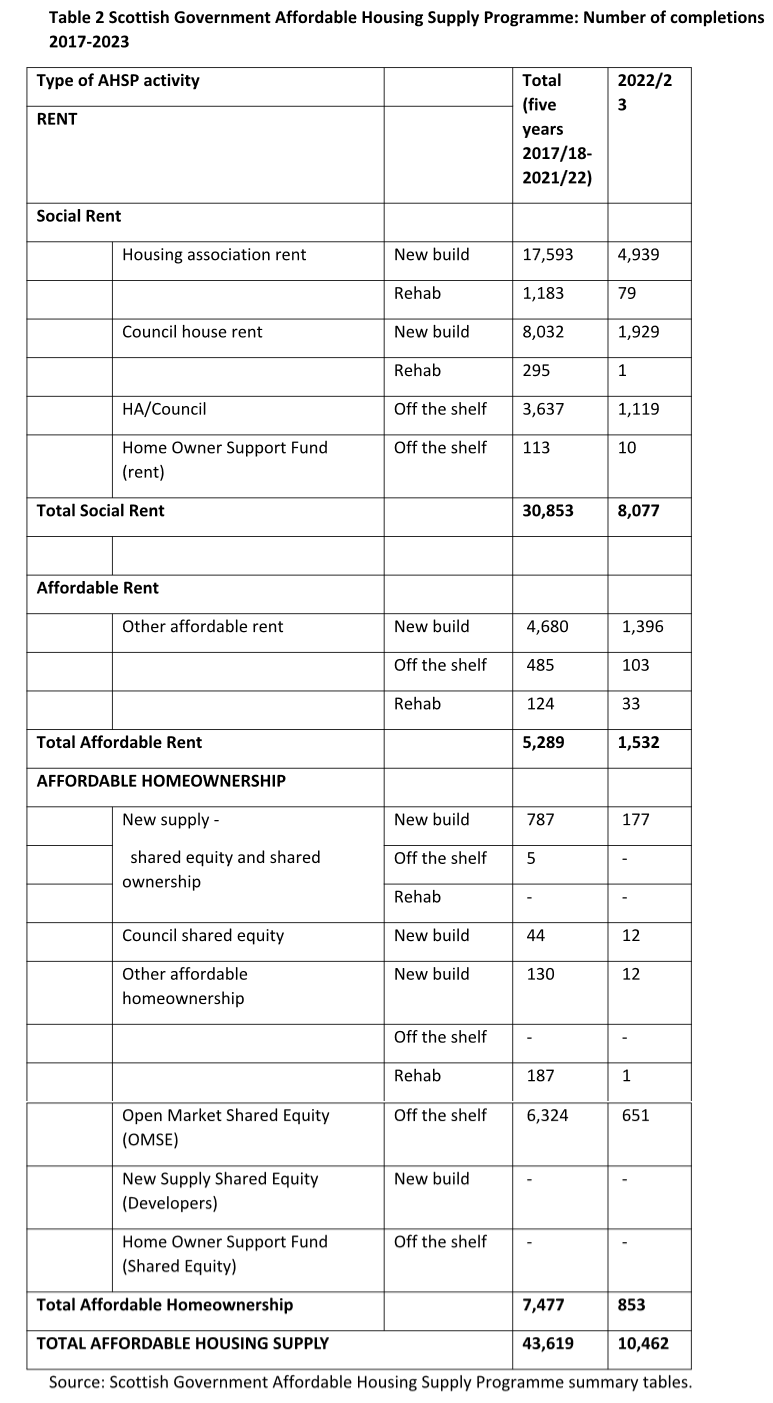

Ironically, the first full year’s contribution to the target was promising, with 10,462 completions in 2022/23, the highest in more than two decades (Table 2). Because of the way achievement of the target is calculated (starting at March 23 2022), a slightly higher total of 11,570 homes had been completed towards it by March 31 2023. The 8,077 completions for social rent in 2022/23 formed 77 per cent of the total, exceeding the government’s target. Furthermore, the 1,780 affordable homes completed in the second quarter of 2023 (not included in the table) were one-fifth higher than the same quarter in 2022.

However, there were already worrying signs that recent progress may be temporary. In 2022/23, starts on site, at 6,990, were well down on the previous year’s 8,227. Approvals also fell from 7,820 to 6,396, and the figure for the second quarter of 2023 was the lowest since 2000. Figures published since the Review was printed indicate that the downward trend continues with approvals, starts and completions all at lower levels in calendar year 2023 than they were in 2022.

Apart from the severe cuts in funding for the AHSP, providers in Scotland face the same challenges as those in the rest of the UK. These include:

- Below-inflation rent increases. After several years of rents keeping ahead of inflation, social landlords are now experiencing the reverse. In 2022/23, average rents rose by only 2.6 per cent. In 2023/24, agreements with the Scottish Government again led to sub-inflation increases, with the average being 5.1 per cent. Despite this restraint, rent arrears at March 2023 reached record levels.

- Financial health of the sector. The Scottish Housing Regulator (SHR) describes the sector as ‘squeezed but robust’, but with several providers having advised it of potential covenant breaches related to interest cover, in recent months. The SHR says the sector faces ‘significant challenges’ in accessing debt, as providers plan to increase borrowing by £1.47 billion over the next five years.

- Investment in existing homes. In contrast with England, Scottish social landlords’ financial plans include a £15 million aggregate reduction in investment in their own stock over the next five years, according to the SHR, alongside the cut in new build output (although with no cut in new build expenditure). This may be because of recent past investment in reaching Scotland’s higher current standards for the stock, although might also suggest that there may be difficulties in achieving the next increment in standards, notably those relating to energy efficiency.

- Affordable housing investment benchmarks. These were raised in 2021 and were subsequently adjusted to account for construction inflation in 2023, with the Scottish Social Housing Tender Price Index being used for this purpose. Despite promised flexibility to deliver viable schemes, providers argue that they are not keeping up with costs. Tender prices increased by 26 per cent in the two years to Quarter 1 2023.

- Quality standards for new homes. More stringent requirements are being placed on all new housing developments, notably that homes will have to meet a Scottish version of the Passivhaus standard, with the legislation likely to be laid in 2025 or 2026 and to come into force later. The extra costs of achieving the standard are clearly an issue, with Midlothian Council recently pausing a 182-unit scheme as costs were said to be more than one-third higher than normal.

Surveys by the SHR showed that housing associations’ development plans for the next five years were forecast to deliver 15 per cent fewer new homes, before the latest cuts in funding were announced. This would put their output at around 5,200 annually. If local authorities continue to provide around 2,000 new homes each year, total output would be only two-thirds of what is required, even before the new cuts in funding. These figures show just how far short of the target providers expect to be.

Latest figures show that up to December 2023, 17,619 affordable homes had been completed towards the target of 110,000: there is a long way to go.

Written by John Perry, from a chapter in the 2024 UK Housing Review.

John is a policy advisor for CIH and contributing editor of the UK Housing Review series. John advises on various subjects, including local authority finance, housing investment, as well managing and editing the CIH housing rights website and newsletter.

The UK Housing Review publication series is a key resource for busy managers and policymakers across the public and private housing sectors in the UK. The Review, published annually each spring, brings together the most important housing statistics for England (and its regions), Wales, Scotland and Northern Ireland. The UK Housing Review series is published by CIH and the University of Glasgow and is available to buy via the CIH website at https://www.cih.org/bookshop with the exception of CIH members who receive it free of charge as a member benefit.