Public housing and infrastructure help ease Scottish construction decline

Workloads in Scottish construction fell at a reduced rate at the end of last year compared to the previous two quarters, assisted by a rise in public housing and infrastructure workloads, according to the RICS Construction and Infrastructure Monitor, Q4 2020.

Despite on-going concerns about COVID and a growing weakness in commercial development, the workload balance for Scotland stood at -11 in Q4 compared to -18 in Q3 and -43 in Q2.

As the high street undergoes transformational change, respondents to the survey highlighted concerns around the structural challenges for both retail and offices that is impacting on development.

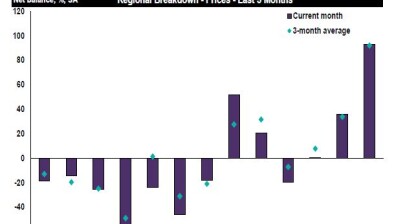

At a sector level, there were modest rises in workload balances for public housing, infrastructure and other public works. However private commercial and private industrial workloads were reported to have experienced steep falls and the private housing workload balance was flat.

Looking ahead, a net balance of +27% of Scottish respondents expect workloads to be higher in a year’s time, with only +6% expecting employment numbers to rise. The balance of respondents expects profit margins to continue to be squeezed.

Alistair Mccracken of Reid Associates in Glasgow said: “Delays getting statutory consents are affecting construction activity, as well as design teams furloughing staff.”

Chris Shields of TCS Construction Consultants in Kilmarnock said that material shortages and longer lead in times were impacting on workloads.

At a UK-level, workloads rose for the first time in a year.

Commenting on the UK picture, Simon Rubinsohn, RICS chief economist, said: “This latest RICS data shows the positive impact that stimulus packages can have on the sector and the wider economy. It is now critical the government continues to focus on delivering on its ambitions around ‘levelling up’ and ‘net zero’ while building a sustainable economic recovery using the forthcoming budget to embed these goals. Green infrastructure, which has an important role to play in supporting this approach, needs to be at the forefront of the priority list.

“Although skill shortages appear to have diminished importance as a constraint in output according to the survey, our suspicion is that this reflects the current environment and is likely to re-emerge as the industry gears up over the next few years. It is thus important that a focus remains on promoting training and development across the sector to build capacity to address future challenges.”