RICS: Homebuyer demand in Scotland picks up through February and surveyors expect sales to increase

Demand from prospective homebuyers in Scotland rose in February according to the latest Royal Institution of Chartered Surveyors (RICS) residential market survey, and surveyors anticipate that sales activity will increase this year.

According to the latest survey results, a net balance of 15% of surveyors in Scotland reported a rise in new buyer enquiries in February, up from 1% in January.

On the supply side, surveyors in Scotland reported that there were more properties coming to the market, but only marginally so. A net balance of 3% of Scottish respondents reported an increase in new instructions to sell.

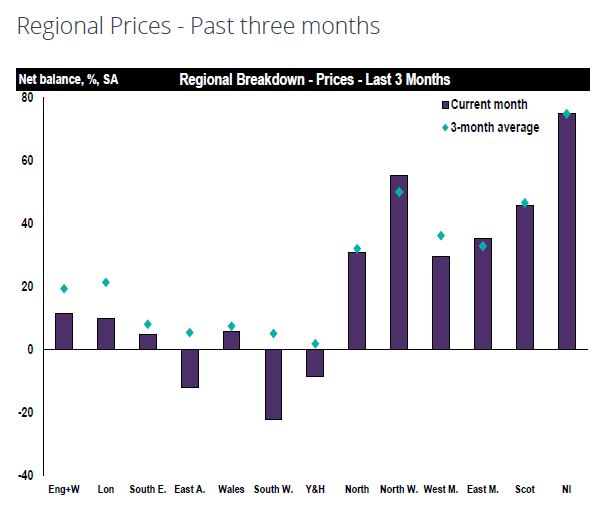

When it comes to pricing, a net balance of 46% of respondents in Scotland noted that house prices rose over the past three months. This is above the average UK balance which sits at 11%.

And looking forward, surveyors remain optimistic on pricing as a net balance of 16% of Scottish surveyors anticipate that prices will rise over the next three months.

On the sales front, for the fifth consecutive month, surveyors in Scotland reported a rise in newly agreed sales. A net balance of 23% of Scottish respondents noted a rise through February, up from 4% seen in January, and 1% seen in December.

On the three-month horizon, a net balance of 29% of surveyors in Scotland expect sales to continue on an upward trajectory, edging upwards from the 27% that was reported the month previous.

Scottish surveyors also expect sales activity to increase over the next 12 months, with a net balance of 47% of respondents expecting sales to be higher in a year’s time (up from 33% last month).

Regarding lettings, a net balance of 13% of surveyors in Scotland reported a rise in tenant demand through February. On the supply side, a net balance of -13% of respondents noted a fall in landlord instructions. When it comes to rental expectations, a net balance of 25% of surveyors anticipate rents to rise over the next three months.

Commenting on the sales market, Jonathan Hunter, MRICS of DM Hall LLP in Edinburgh/East & Midlothian said: “Instruction and activity levels increased into February however, the school holidays in mid-February slowed proceedings. Market activity picked up significantly in the later part of the month, possibly fuelled by the news of reduced mortgage rates.”

Discussing the rental market, Grant Robertson, FRICS of Allied Surveyors Scotland in Glasgow commented: “Rental values softened over the winter market and remain below previous peaks across most property types.”

Commenting on the UK picture, Simon Rubinson, RICS chief economist, said: “The UK housing market appears to be losing some momentum as the expiry of the temporary increase in stamp duty thresholds approaches. Some concerns are also being expressed by respondents about the re-emergence of inflationary pressures and the more uncertain geopolitical environment. That said, looking beyond the next few months, sales activity is seen as likely to resume an upward trend with prices also moving higher.

“A key support for the market continues to be the increased flow of existing stock becoming available, giving buyers a greater choice of options. However, leading indicators around new build remain subdued for now, highlighting the significance of the Planning and Infrastructure Bill introduced to Parliament this week.

“Meanwhile, despite a flatter trend in demand for private rental properties, the key RICS metric capturing rental expectations is still pointing to further increases demonstrating that the challenge around supply spans all tenures.”